Understanding Offshore Trust Property Defense: Provider to Secure Your Possessions

If you're looking to secure your wealth, understanding overseas trust possession protection is important. These trusts can supply an effective shield against financial institutions and legal insurance claims, ensuring your possessions remain safe. By checking out the advantages, types, and solutions supplied by offshore depend on providers, you'll discover critical methods to enhance your financial protection. How do you select the appropriate jurisdiction and navigate the lawful landscape? Let's explore the important steps included.

What Is an Offshore Depend On?

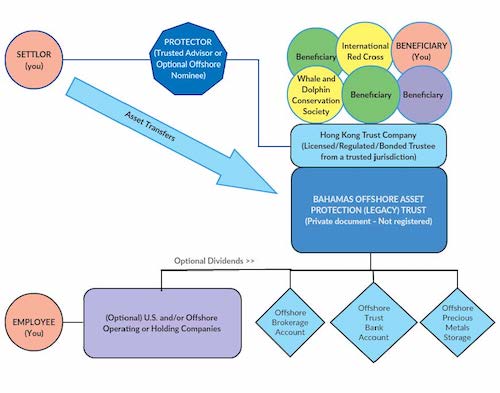

An offshore count on is a legal setup where you put your properties in a count on handled outdoors your home nation. When you develop an offshore count on, you assign a trustee that manages the assets according to your specified terms.

You can select various kinds of offshore trusts, such as optional or set trust funds, based on your monetary objectives. Furthermore, you can designate beneficiaries who will get the trust fund's possessions in the future. Offshore depends on can likewise use privacy, as they frequently shield your economic information from public analysis. Overall, comprehending exactly how an overseas count on works equips you to make informed decisions concerning guarding your wide range properly.

Benefits of Offshore Trust Funds for Possession Protection

Another substantial advantage is tax effectiveness. Depending on the jurisdiction, you could gain from desirable tax treatments, which can assist you protect more of your riches. Offshore trusts can additionally offer flexibility regarding asset administration and distribution, enabling you to customize the depend your particular needs and goals.

Kinds of Offshore Counts On

When taking into consideration overseas trusts, you'll encounter various types, mainly revocable and irreversible trust funds. Each offers different functions and supplies distinct levels of asset protection. Furthermore, recognizing optional and non-discretionary trust funds is vital for making educated choices about your estate preparation.

Revocable vs. Irreversible Depends On

Comprehending the distinctions between revocable and irrevocable counts on is vital for anybody thinking about overseas property security. A revocable trust enables you to maintain control over the possessions, allowing you to modify or dissolve it anytime.

On the various other hand, an unalterable depend on removes your control when developed, making it a lot more secure from lenders. You can't transform or revoke it without the authorization of the recipients, which provides more powerful asset defense. Choosing in between these kinds depends upon your economic objectives and take the chance of resistance, so evaluate the advantages and disadvantages very carefully prior to choosing.

Discretionary vs. Non-Discretionary Counts On

Optional and non-discretionary counts on serve various purposes in offshore property security, and knowing which kind fits your demands can make a considerable distinction. In a discretionary depend on, the trustee has the adaptability to decide how and when to disperse possessions to beneficiaries. This can give greater security from creditors, as recipients don't have guaranteed accessibility to funds. On the other hand, a non-discretionary trust needs the trustee to adhere purely to determined terms, making sure recipients receive certain circulations. While non-discretionary trusts provide predictability, they might reveal assets to cases in particular circumstances. Inevitably, recognizing these differences aids you customize your overseas trust fund method to effectively protect your assets and attain your economic objectives.

Trick Services Used by Offshore Count On Companies

Several overseas count on carriers use a series of crucial solutions made to protect your properties and warranty conformity with worldwide guidelines. One essential service is asset management, where professionals supervise your financial investments to make the most of returns while decreasing risks. They also provide trust fund management, ensuring your count on runs efficiently and follows legal demands.

Tax preparation is another crucial solution, assisting you enhance your tax obligation circumstance and stay clear of unnecessary responsibilities. In addition, these service providers typically offer estate preparation support, guiding you in structuring your depend satisfy your long-lasting objectives and protect your heritage.

Ultimately, several deal reporting and compliance services, guaranteeing you meet yearly declaring needs and preserve transparency with governing bodies. By capitalizing on these solutions, you can improve the defense of your possessions and achieve satisfaction recognizing that your financial future remains in qualified hands.

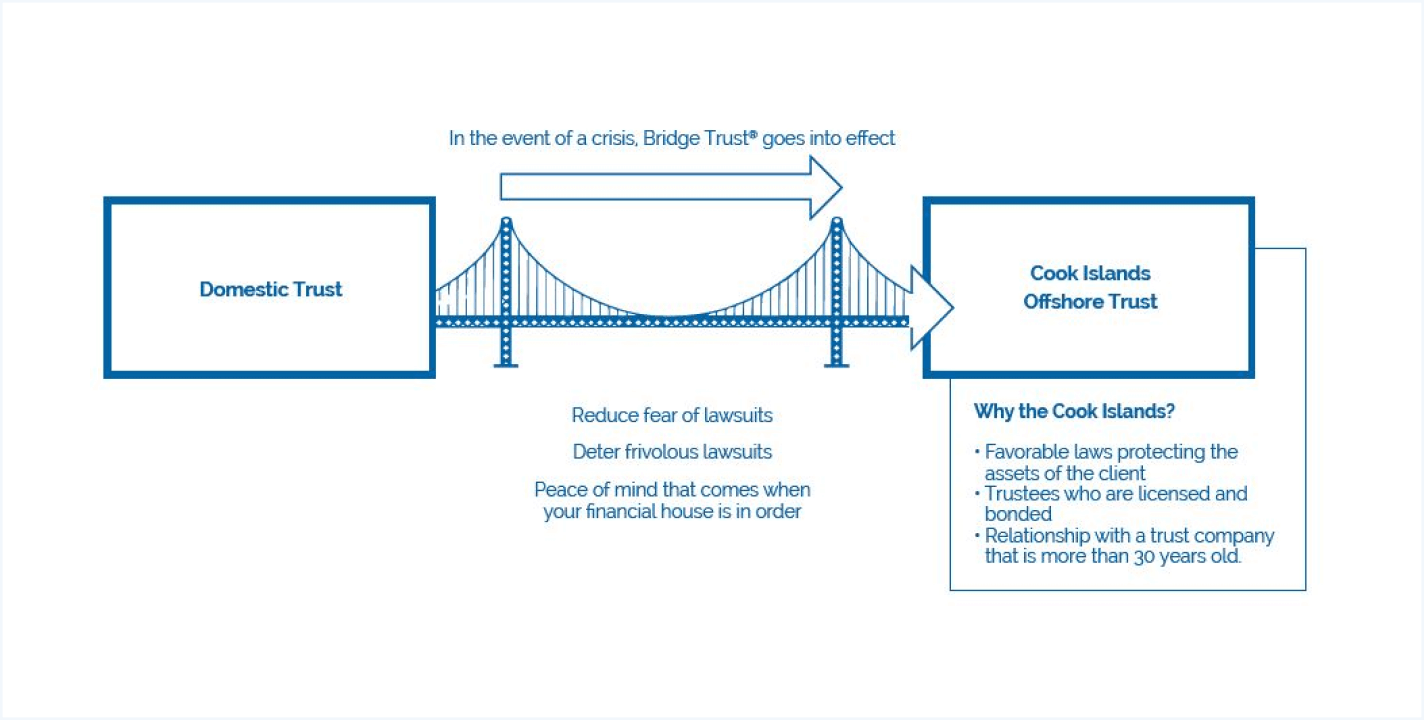

Selecting the Right Territory for Your Offshore Count On

When selecting the ideal territory for your overseas depend on, you require to ponder the property security laws, tax obligation implications, and the general online reputation of the location. Each territory offers one-of-a-kind advantages and challenges that can greatly affect your count on's effectiveness. By comprehending these factors, you can make an extra informed decision that aligns click here for more with your financial goals.

Jurisdictional Property Protection Laws

Choosing the ideal territory for your overseas count on is vital, as it can considerably impact the level of property defense you receive. Different jurisdictions have varying asset protection regulations, which can secure your assets from lenders and legal insurance claims. Look for countries with strong legal structures that prioritize trust personal privacy and deal favorable laws.

Tax Obligation Effects and Benefits

Exactly how can understanding tax effects boost the benefits of your overseas trust? By picking the appropriate jurisdiction, you can potentially lower your tax obligation and optimize your possession security. offshore trusts asset protection. Some overseas locations offer beneficial tax obligation rates or even tax obligation exemptions for trusts, enabling your possessions to grow without heavy taxation

In addition, understanding regional tax obligation regulations can help you structure your trust successfully. You'll wish to take into account just how income generated by the count on is exhausted and recognize any kind of coverage needs.

Lawful Security and Online Reputation

As you discover alternatives for your offshore trust fund, recognizing the legal stability and online reputation of prospective territories is essential. A jurisdiction with a solid lawful structure guarantees your assets are secured and much less vulnerable to political or financial instability. Examine the nation's regulations pertaining to property security and trust fund monitoring; some jurisdictions provide positive laws, while others may have limiting practices.

This diligence will certainly help you select a place that not just safeguards your properties yet likewise offers peace of mind for the future. Inevitably, an audio selection enhances your depend on's efficiency and protection.

Legal Factors To Consider and Conformity

While establishing an offshore depend on can supply substantial property security benefits, it's important to browse the complex lawful landscape with care. You'll require to recognize the regulations regulating count on both your home nation and the jurisdiction where the trust fund is developed. Compliance with tax laws is necessary, as failing to report overseas accounts can result in extreme penalties.

Additionally, you need to be mindful of international treaties and contracts that may influence your count on's procedures. Each country has unique requirements for documentation, reporting, and governance, so you'll wish to speak with legal and financial consultants experienced in offshore trusts.

Staying certified isn't almost staying clear of lawful troubles; it also assures that your assets are secured according to the regulation. By focusing on legal considerations and compliance, you secure your riches and preserve comfort as you browse this intricate process.

Steps to Establishing an Offshore Count On

Establishing an overseas trust fund entails numerous vital actions that can help improve the process and guarantee your assets are legitimately safeguarded. Initially, you'll need to select a trusted territory that supplies beneficial laws special info for possession protection. Research numerous countries and think about variables like tax obligation ramifications and lawful stability.

Following, pick a reliable trustee. This might be a banks or a private experienced in taking care of trusts. Make sure they understand your objectives and can abide by regional guidelines.

As soon as you have actually chosen a trustee, you'll prepare the count on record. This ought to detail your intents and define recipients, assets, and distribution techniques. Consulting with a lawful expert is necessary to see to it your file satisfies all requirements.

Often Asked Inquiries

Can I Establish an Offshore Depend On Without an Economic Expert?

You can establish an offshore count on without an economic consultant, however it's risky. You might miss essential lawful needs or tax obligation ramifications. Study thoroughly, and think about seeking advice from experts to ensure everything's done correctly.

How Much Does It Price to Keep an Offshore Trust Each Year?

Preserving an overseas count on annually can cost you anywhere from a few hundred read this post here to a number of thousand bucks. Aspects like jurisdiction, intricacy, and trustee fees influence these expenses, so it's smart to spending plan appropriately.

Are Offshore Trusts Only for Wealthy People?

Offshore depends on aren't just for wealthy individuals; they can benefit anybody seeking to shield assets or strategy for the future. They provide personal privacy and flexibility, making them obtainable for a broader array of financial scenarios.

What Takes place if I Adjustment My Mind Concerning the Trust Fund?

If you transform your mind about the trust, you can commonly customize or withdraw it, relying on the depend on's terms. offshore trusts asset protection. Seek advice from your lawyer to guarantee you adhere to the right legal treatments for modifications

Can I Accessibility My Possessions in an Offshore Trust Fund any time?

You can't access your assets in an overseas count on any time. Usually, these trusts limit your control to secure properties. You'll require to follow the depend on's standards to gain access to funds or property.

Conclusion

To summarize, recognizing overseas depend on asset security can be a game-changer for securing your wealth. By capitalizing on specialized services and selecting the appropriate jurisdiction, you can successfully protect your properties from lenders and lawful claims. Remember, establishing an overseas count on isn't just concerning security; it has to do with guaranteeing your monetary future is protected. So, take the following actions today to discover exactly how an overseas trust fund can profit you and your enjoyed ones.